India at the Global Nerve Centre

India's Global Capability Centers (GCCs) ecosystem is roaring ahead in 2025. In the first half of the year, global corporations added ~35+ new or expanding GCCs to India, translating to two to three new centres per week, according to industry trackers.

This momentum helped fuel record office leasing, contributing to India's 35–40% share in national office absorption. More than ever, GCCs in India are becoming innovation powerhouses, leading in AI, R&D, and digital transformation.

Explore related: Global Capability Centers in India – Country Trends & Location Strategy

New Entrants vs. Expansions: The Leadership Tilt

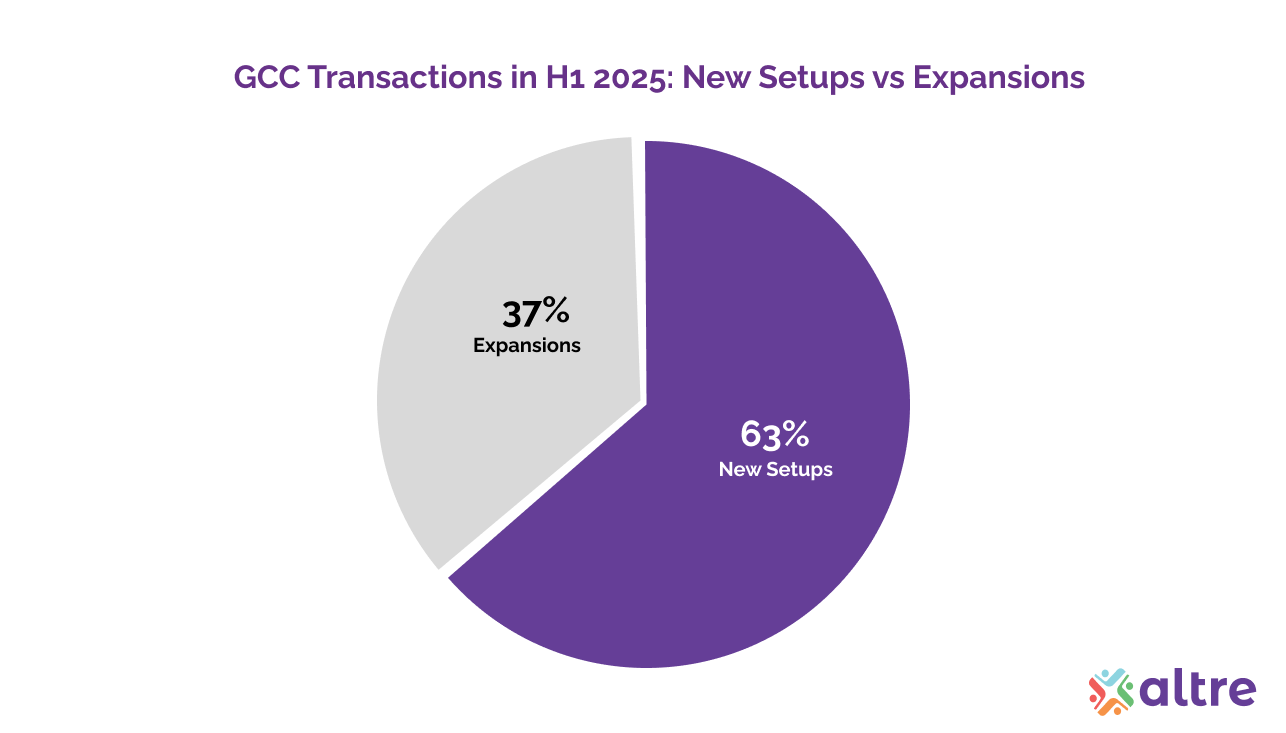

Nearly two-thirds (63%) of setups in H1 were new GCCs in India, signaling strong corporate confidence in India's strategic value. The remaining 37% represented GCC expansions, where mature centres scaled operations to meet rising global demand.

This dual pattern underscores India's appeal: it continues to attract fresh global players, while existing occupiers are doubling down with larger campus-scale investments and innovation-ready real estate footprints.

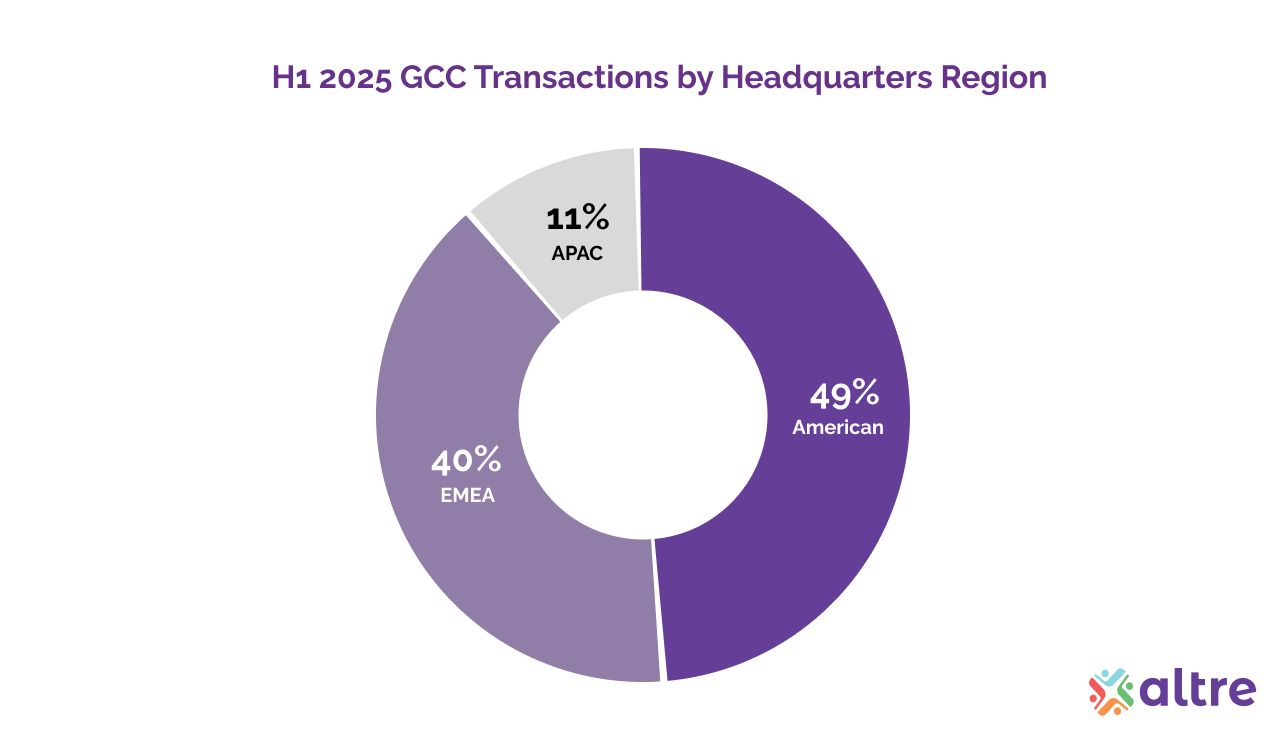

Global HQ Origins: Where the Energy Comes From

-

U.S.-headquartered firms drove nearly 50% of GCC activity, highlighting India's continuing strategic importance to American corporations.

-

EMEA-based organisations (UK, Germany, Netherlands, Austria, Norway, Ireland) contributed about 40%.

-

APAC-headquartered companies (Japan, New Zealand) accounted for ~10%, showing India's dominance over regional alternatives like Southeast Asia.

This reinforces India's position as the preferred global hub for GCCs, bridging North America and Europe with scalable operations.

For more context: Solving for Location – A New Way to Evaluate India's Office Markets

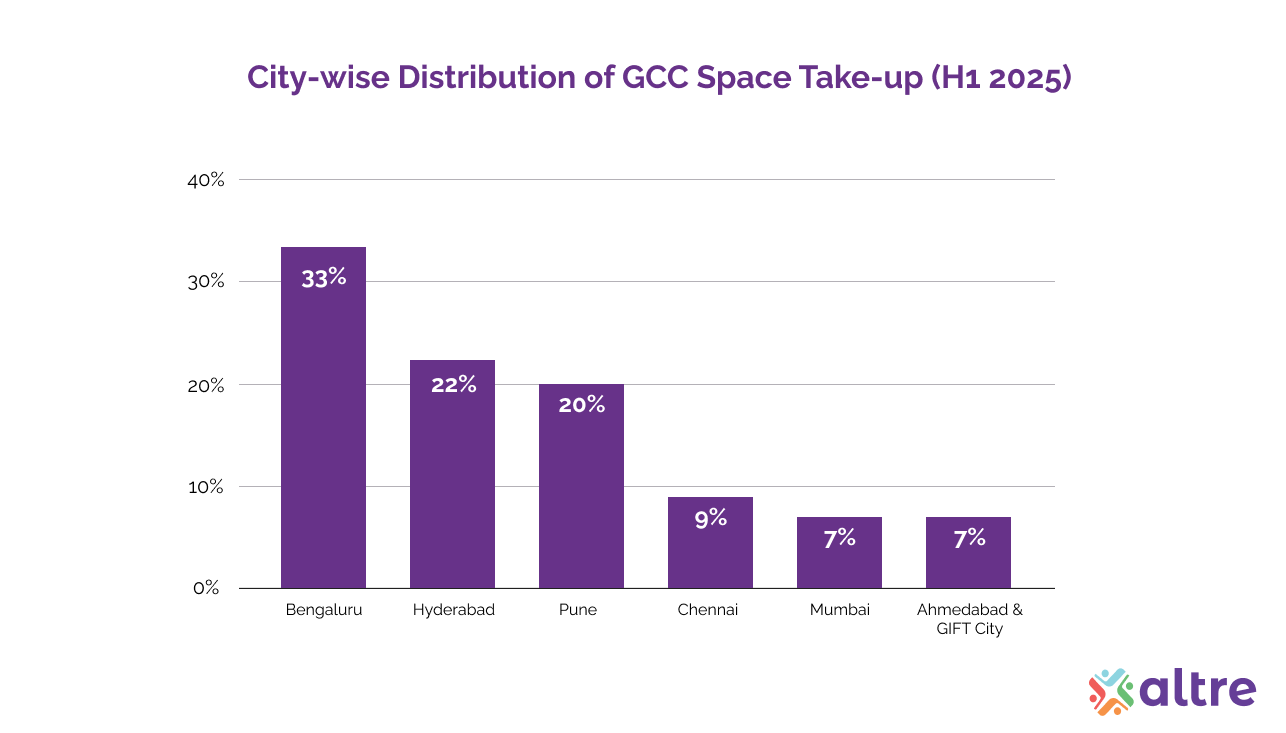

India's Preferred GCC Hubs

India's GCC census in H1 2025 shows three cities leading the charge:

-

Bengaluru – handled ~34% of tracked GCC activity, retaining its status as India's GCC capital.

-

Hyderabad – captured ~23%, driven by infrastructure readiness and state-backed policy incentives.

-

Pune – contributed ~20%, supported by BFSI and technology sector growth.

Together, these hubs accounted for ~77% of GCC setups and expansions. Secondary locations such as Chennai, Mumbai, GIFT City, and Ahmedabad shared the remaining 23%, reflecting early Tier-2 GCC growth in India.

See coworking options in Bengaluru and Hyderabad.

Centre Types & Industry Mix

The H1 surge reflects broader industry strategy shifts:

-

Technology & AI GCCs in India: New labs and AI-first hubs (e.g., Deloitte, Cognite) focused on building next-gen platforms.

-

BFSI GCCs: Citigroup and BlackRock expanded India hubs for global financial services delivery.

-

Healthcare & Pharma GCCs: AstraZeneca, Medtronic, and Entain set up AI-driven life sciences and pharma-tech centres.

-

Retail & Consumer GCCs: McDonald's, Walmart, and Heineken established digital delivery and analytics hubs, proving India's relevance beyond IT services.

India is now the global innovation engine across multiple industries, not just a back-office for technology.

Strategic Trends Reshaping GCC Real Estate

-

India's Value Proposition Deepens

GCCs are moving beyond cost arbitrage toward deep value creation in AI, R&D, and SaaS engineering. For instance, Cognite's Bengaluru hub is an AI-first GCC for its Atlas AI platform, while Syneriq Global's Hyderabad centre focuses on AI/ML and product engineering. -

Campus-Scale Real Estate Investments

New GCC expansions are synonymous with large-scale campuses. Deloitte's multi-million sq ft Bengaluru hub and Citigroup's ~770,000 sq ft Pune growth illustrate how GCCs are driving Grade-A office space demand in India.

See our 2025 CRE Sustainability Report – The Green Imperative for how green campuses are reshaping occupier preferences.

-

Hybrid Core-Plus-One Location Models

While Bengaluru and Hyderabad remain core hubs, Tier-2 cities like Visakhapatnam, GIFT City, and Ahmedabad are gaining traction as India+1 GCC destinations, offering redundancy and access to fresh talent. -

Workforce Growth

India's GCC workforce stands at ~2 million, projected to cross 2.7 million by 2030. Supported by public-private initiatives like the IndiaAI Mission, headcount expansion is inevitable.

Explore coworking in Gurugram for scalable GCC-ready spaces.

Talent & Workforce Dynamics

Half of surveyed GCCs in India plan to expand headcount beyond 2024 levels. Examples:

-

BlackRock scaled its Mumbai hub for deeper asset management delivery.

-

AstraZeneca invested further in Bengaluru and Chennai for AI-driven healthcare.

-

Medtronic launched a diabetes-focused GCC in Pune, highlighting the rise of healthcare GCCs in India.

These moves confirm that GCCs are no longer peripheral, they are embedded into global business models as strategic innovation engines.

Conclusion: India's GCC Momentum Continues

In H1 2025, India witnessed:

-

63% of activity from new GCC launches, 37% from expansions.

-

Bengaluru, Hyderabad, and Pune dominating, together hosting >75% of GCC activity.

-

American and European HQ firms driving demand, with APAC still nascent but expanding.

-

AI-led R&D, SaaS engineering, and digital innovation becoming the new GCC baseline.

As India enters H2 2025 and looks ahead to FY 2026, its GCC ecosystem is in a post-transformation phase, positioned to become a global innovation grid by 2030.

Learn more: Coworking Solutions Across India