Why Focus on the Philippines Office Market

The Philippines'office real estate market is entering a period of renewed momentum, with rapid recovery and expansion making it increasingly relevant to global occupiers. In 2025, companies that broaden their view beyond traditional hubs will be better positioned to address labor shortages, cost fluctuations, and geopolitical risks. The Philippines is no longer seen merely as a fallback; it is positioning itself as a strategic node in the future of work in Asia.

With improving infrastructure, a strong BPO and IT-BPM base, English-speaking talent, and competitive office rental rates, the country presents itself as an alternative or complement to more saturated markets like India. Yet while the Philippines is gaining visibility, India's office real estate market remains significantly larger and more diverse, continuing to anchor the majority of GCC, IT, BFSI, and startup demand across Asia.

Explore more on India's strength: Solving for Location – A New Way to Evaluate India's Office Markets.

Current Trends in the Philippines Office Sector

The Philippines is seeing a surge in demand for office space, led by the IT-BPM industry and a rise in government leasing activity. Despite challenges such as the exit of Philippine Offshore Gaming Operators (POGOs), the market remains resilient. Occupiers continue to show interest in Metro Manila and emerging provincial hubs.

By contrast, India's commercial real estate sector in 2025 reflects broader demand drivers. In addition to IT-BPM, GCC expansions, startup growth, and flexible workspace leasing fuel record absorption, making India the regional leader for office occupiers.

Related: Coworking in Bengaluru – India's GCC Capital.

Key Factors Influencing Growth

Several factors underpin the Philippines'growth trajectory. Special Economic Zones (SEZs) in Metro Manila and Cebu simplify the process for multinational companies to establish operations. Large infrastructure projects, such as the Metro Manila Subway, are improving connectivity and unlocking new development corridors. Relatively affordable living costs compared to other Asian cities make it attractive for both local and international talent.

However, the India vs Philippines office market comparison highlights India's stronger fundamentals. India's SEZ framework spans multiple Tier 1 and Tier 2 cities, while its infrastructure pipeline includes metro networks, expressways, and airport linkages across Bengaluru, Hyderabad, Pune, Delhi-NCR, and Gurugram. Most importantly, India's vast talent base, millions of STEM graduates annually, provides a scalability advantage that the Philippines cannot match as of now.

External reference: World Bank – Philippines Overview.

India vs Philippines Office Market: The Scale Gap

The size disparity between the two markets is clear. As of Q1 2025, India's office market stood at more than 850 million square feet of Grade A supply across the top 8 cities. The Philippines, in comparison, had approximately 8.5 million square meters (91 million square feet) of office stock, with Metro Manila accounting for around 75%.

In other words, India's Grade A office market is around ten times larger than that of the Philippines. India's depth and diversity are also far greater, driven by IT services, startups, BFSI, and global capability centers (GCCs). The Philippines, while growing, continues to rely heavily on BPO, healthcare, and insurance-led demand.

See: Global Capability Centers in India – Country Trends & Location Strategy.

Similarities and Differences

Both countries share some parallels: young workforces, urbanization-led real estate growth, SEZ policies, and strong government support. However, the differences define their strategic positioning. India offers scale, sector diversity, and GCC-led innovation hubs, while the Philippines specializes in customer-facing BPO, CX, and IT support functions. For multinational occupiers, India becomes the primary hub for large-scale, long-term operations, with the Philippines serving as a complementary site.

Implications for Businesses and Investors

For businesses considering expansion in Asia, both markets present opportunities. The Philippines stands out for its growth momentum, favorable policies, and competitive office rentals. However, for companies with large-scale office needs, India remains the clear leader, with an unparalleled supply pipeline, stronger infrastructure, and an established reputation as a global office hub.

Investors should note that while the Philippines is growing steadily, India continues to dominate Asia's Grade A office absorption, with deeper demand from multinational occupiers across GCC, IT, BFSI, and emerging tech sectors.

Related: The Green Imperative – 2025 CRE Sustainability Report.

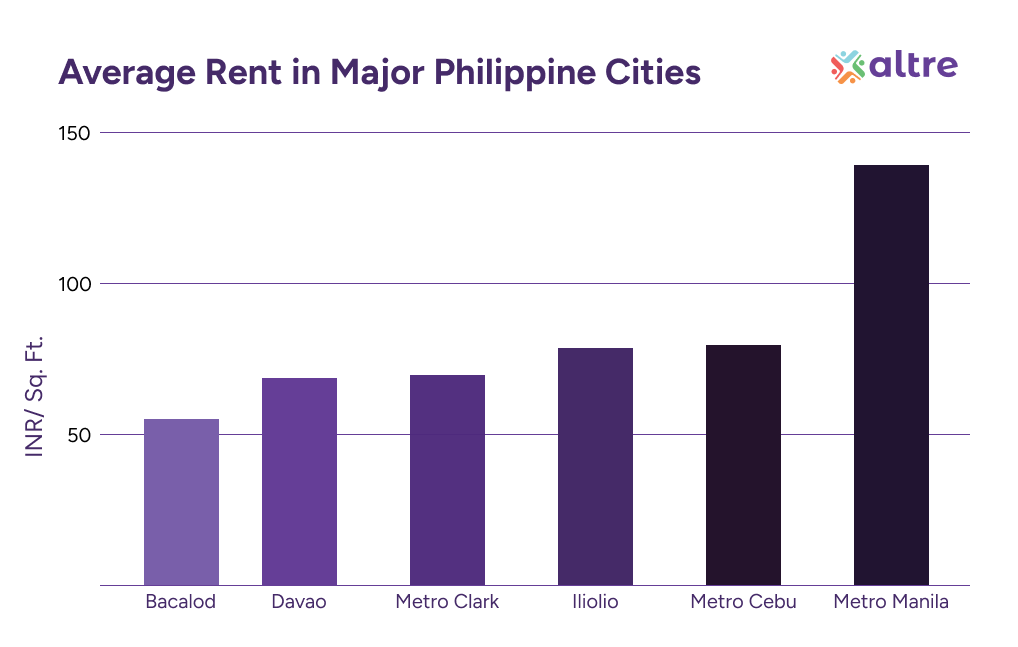

Real Estate Infrastructure Development

The Philippines'real estate market was valued at USD 90.51 billion in 2024, underpinned by urbanization, economic growth, and rising demand for both commercial and residential assets. Rental costs remain highly competitive, with Bacolod at INR 55.3 per sq.ft./month, Davao at INR 69.48, Metro Clark at INR 70.5, Iloilo at INR 79.7, Metro Cebu at INR 80.28, and Metro Manila at INR 140.61.

India's office rental markets, by comparison, offer both premium districts such as Mumbai's Bandra Kurla Complex (BKC) and Delhi NCR's Cyber City, as well as cost-efficient emerging corridors like Noida Expressway, Bengaluru ORR, and Pune Kharadi. Coupled with India's deeper supply of green-certified Grade A stock, the Indian market remains far more flexible and scalable.

Office Space Supply and Availability

In the Philippines, supply growth remains controlled with low vacancies. Metro Manila leads with 8.12 million sq.ft. of upcoming supply and vacancy of 0.475%. Cebu has 1.74 million sq.ft. under construction with 2.6% vacancy. Davao and Bacolod each have smaller pipelines of less than a million sq.ft., with vacancy rates below 0.5%. Iloilo and Metro Clark offer moderate growth, with vacancies under 1.2%.

This shows strong demand and stability, but the overall scale remains limited. In India, the top eight cities alone delivered tens of millions of square feet in new supply in 2024, with vacancy rates hovering in the single digits. India's sheer supply scale combined with strong absorption, gives global occupiers confidence in long-term expansion.

Role of Policy and Remittances

The Philippines'office market continues to benefit from government infrastructure initiatives and inflows from overseas Filipino worker (OFW) remittances, which support property investment. Improved transport networks, stronger telecom infrastructure, and modernized business districts have positioned the Philippines for continued expansion.

India, in comparison, benefits from large-scale national programs such as the Gati Shakti masterplan and city-level infrastructure pushes across metro and expressway corridors. For global occupiers, India's policy depth and infrastructure pipelines reinforce its position as the leading office market in Asia.

Conclusion: India's Office Real Estate Advantage

The Philippines'office real estate market in 2025 is competitive, resilient, and growing steadily. Controlled supply growth, low vacancies, and supportive government policies are positive indicators. However, compared to India's commercial real estate ecosystem, the Philippines remains smaller, narrower, and less diverse.

For occupiers, investors, and developers, the message is clear: India is the stronger and more future-ready choice. With unmatched scale, a deep pool of STEM and IT talent, and world-class Grade A supply pipelines across multiple cities, India continues to dominate as Asia's most strategic office real estate destination. The Philippines may play a complementary role in niche operations, but India remains the global hub for office demand and GCC growth.