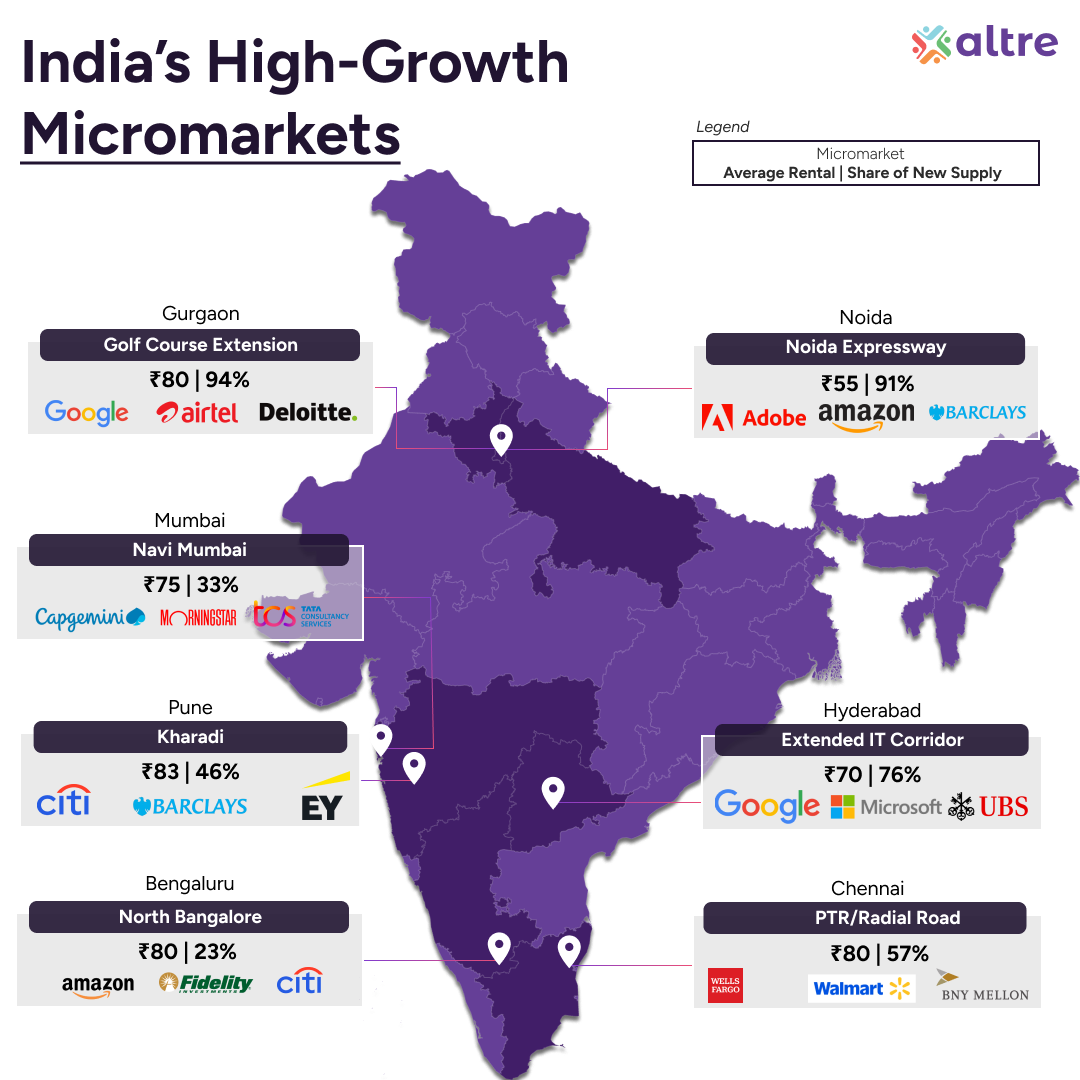

A New Map of India's Office Leasing

India's office market is undergoing a structural shift. In Q1 2025, nearly 25% of all office space leasing came from just seven emerging micromarkets—a clear signal that the future of commercial real estate is moving beyond traditional central business districts (CBDs).

These corridors are being shaped by infrastructure upgrades, increasing GCC activity, and proactive urban development. In a market where cost-efficiency, accessibility, and modern Grade-A supply define tenant choices, these micromarkets are rewriting the rules of India's office leasing market.

Related read: Global Capability Centers in India: Country Trends & Location Strategy

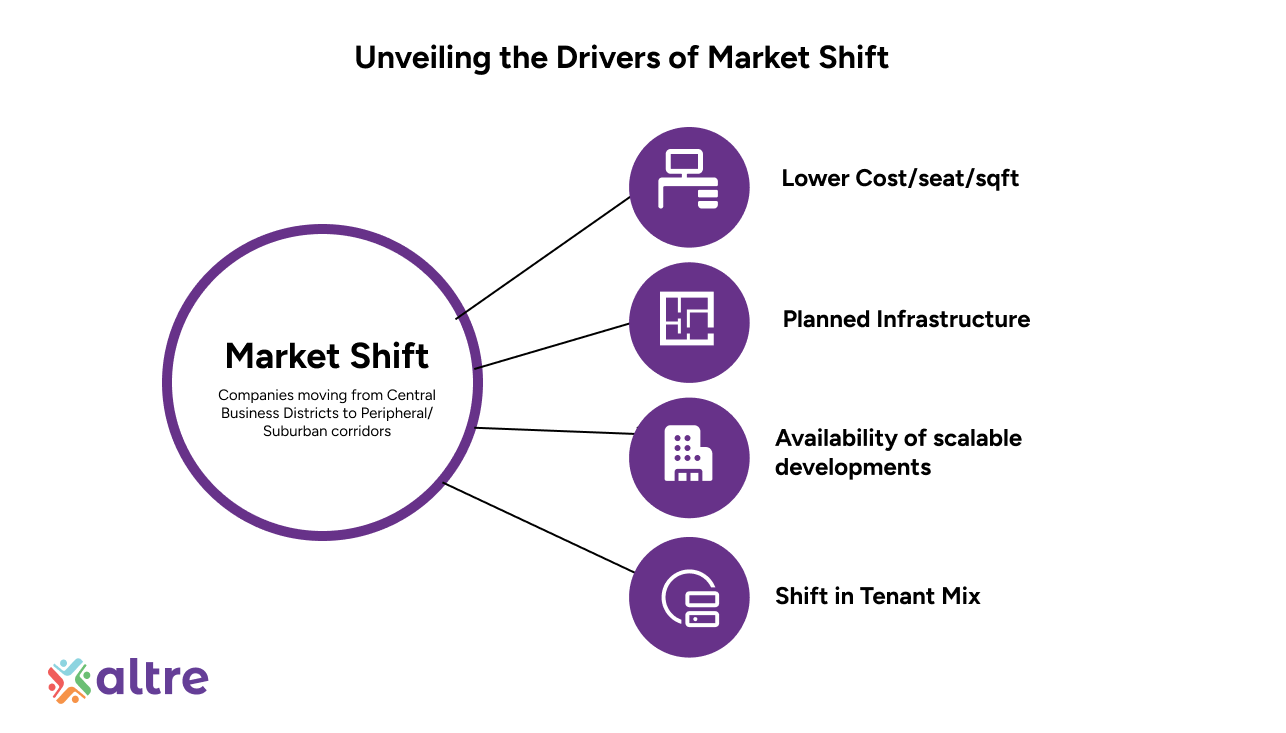

What's Driving the Market Shift?

Occupiers are migrating from CBDs to suburban and peripheral corridors due to:

-

Lower cost-per-seat economics: Emerging hubs offer 20–30% lower rents than CBDs.

-

Infrastructure upgrades: Metro expansions, new expressways, and airport access are reshaping location attractiveness.

-

Campus-style developments: Large, scalable Grade-A supply that CBDs cannot match.

-

Changing tenant mix: Global Capability Centers (GCCs), BFSI majors, and tech giants are anchoring demand.

Explore more: Solving for Location – A New Way to Evaluate India's Office Markets

Bangalore – North Bangalore: Long-Term Bet on Connectivity and Scale

North Bangalore is quickly establishing itself as a strategic office corridor thanks to seamless access to Kempegowda International Airport and planned projects such as the Satellite Town Ring Road (STRR) and upcoming metro extensions.

Large developers are unlocking land for integrated campuses, with projects like Prestige Tech Cloud and CapitaLand IT Park leading the charge. Occupiers including Amazon, Fidelity, and Citibank have already begun setting up GCCs and innovation hubs here.

-

Average rent: ?80/sq.ft./month (vs. city avg. ?104)

-

Value proposition: Scale + long-term capital appreciation

See coworking options in Bangalore.

Navi Mumbai: Infra-Led Emergence

Navi Mumbai is underpinned by marquee infrastructure projects: the Navi Mumbai International Airport, Mumbai Trans Harbour Link, and metro expansions.

Low vacancy and strong absorption in Q1 signal high potential for occupiers seeking affordability and connectivity. Major occupiers like TCS, Capgemini, and Morningstar are already present.

-

Average rent: ?75/sq.ft./month (vs. Mumbai avg. ?199)

-

Value proposition: Cost-efficient alternative for space-intensive occupiers

Hyderabad – Extended IT Corridor (Nanakramguda)

Hyderabad's Outer Ring Road corridor around Gachibowli, Nanakramguda, and the Financial District is the city's most active development zone.

With the largest upcoming supply pipeline over the next 2–3 years, projects like Phoenix Business Hub and EON are designed for large-format IT, Pharma, and BFSI tenants. Major occupiers already include Micron, UBS, Microsoft, and Google.

-

Average rent: ?70/sq.ft./month (vs. city avg. ?75)

-

Value proposition: High absorption capacity with future-ready infrastructure

Explore coworking spaces in Hyderabad.

Noida Expressway: NCR's GCC Magnet

The Noida Expressway is emerging as a top GCC corridor, driven by infrastructure, policy, and airport-led growth.

Connectivity via the Noida–Greater Noida Expressway, Delhi-Mumbai Expressway spur, and Eastern Peripheral Expressway, alongside the upcoming Jewar International Airport, makes this corridor highly attractive.

State policy is also GCC-friendly, with global names like Adobe, Amazon, and Barclays showing strong leasing interest.

-

Average rent: ?55/sq.ft./month (vs. NCR avg. ?98)

-

Value proposition: Low cost + strong GCC demand + logistics synergies

Gurugram – Golf Course Extension Road: Premium Location

Golf Course Extension Road (GCER) is now NCR's most premium, well-connected micromarket, thanks to Southern Peripheral Road (SPR), metro expansion, and proximity to affluent residential zones.

Grade-A projects like Max Gurgaon 65 and AIPL Business Club are setting new benchmarks. Occupiers include Google, Deloitte, Mamaearth, and PepsiCo.

-

Average rent: ?80/sq.ft./month (near NCR avg.)

-

Value proposition: Premium occupiers targeting top talent with lifestyle integration

See coworking options in Gurugram.

Pune – Kharadi: Ecosystem Advantage

Kharadi remains Pune's most dynamic office hub due to proximity to Pune Airport, connectivity via metro and highways, and adjacency to established commercial zones like Magarpatta and Koregaon Park.

Landmark campuses like EON IT Park and new developments like Panchshil Vantage are drawing Barclays, Citibank, and EY.

-

Average rent: ?83/sq.ft./month (vs. Pune avg. ?95)

-

Value proposition: Talent ecosystem + scalable supply + live-work-play integration

Explore coworking spaces in Pune.

Chennai – Radial Road (PTR): BFSI & Tech Powerhouse

Radial Road (PTR) is fast becoming Chennai's next premium corridor, connected to GST Road, OMR, and Phase-II Metro.

What sets it apart is sustainability—projects like CapitaLand's International Tech Park (net-zero, IGBC-certified) are redefining quality benchmarks. Occupiers include Walmart, Wells Fargo, and BNY Mellon.

-

Average rent: ?80/sq.ft./month (vs. city avg. ?77.5)

-

Value proposition: ESG-ready Grade-A supply + airport connectivity

Emerging Micromarkets Snapshot

| Micromarket | Avg Cost (?/sqft/mo) | Vacant Supply (Mn sqft) | Share of New Supply | Q1 Absorption (Mn sqft) |

| North Bangalore | 80 | 15 | 23% | 0.2 |

| Navi Mumbai | 75 | 6 | 33% | 0.7 |

| Hyderabad Periphery | 70 | 31 | 76% | 1.0 |

| Noida Expressway | 55 | 2 | 91% | 0.6 |

| Golf Course Ext Road | 80 | 3 | 94% | 0.3 |

| Pune Kharadi | 83 | 11 | 46% | 0.8 |

| Chennai PTR | 80 | 4 | 57% | 0.7 |

Takeaways for Developers & Occupiers

-

Occupier strategies are moving beyond CBDs in favor of scale, access, and cost-efficiency.

-

Developers should double down on emerging corridors, early movers will benefit from rent appreciation and tenant stickiness.

-

Vacancy is opportunity: high-supply hubs like Hyderabad and Bangalore are future-ready.

-

Micromarkets with airport and metro connectivity consistently outperform.

See also: 2025 CRE Sustainability Report – The Green Imperative

Conclusion: The Market's Next Phase

If Q1 2025 is any indication, India's next leasing hotspots aren't the glass towers of old CBDs but infrastructure-backed, future-ready micromarkets.

For occupiers, developers, and investors alike, these corridors are now at the top of the priority list.